ivari Life Insurance Review

Learn more about ivari life insurance in Canada. Talk to one of our experienced advisors, today!

9 Minute read

Originally Published: November 10, 2021

Updated: October 10, 2024

ivari Life Insurance Review.

Learn more about ivari life insurance in Canada. Talk to one of our experienced advisors, today!

9 Minute read

Originally Published: November 10, 2021

Updated: October 10, 2024

ivari has been providing life insurance solutions for the past 80 years, and has impressive financial backing from their parent company the Canadian Pension Plan Investment Board, making their financial strength rating of A+ from AM Best Company. They’re one of the best insurance providers in Canada, with $11 billion in total assets under management and total premium revenue of $968 million in 2021. They offer 10 year, 20 year, and a 30 year term life insurance with unique features, but they lack a whole life insurance policy product, thus leading us to the rating of 3.5/5 stars from Protect Your Wealth.

In this article:

Company Overview

ivari Insurance, founded in 1927 is owned by the Canadian Pension Plan Investment Board (CPP Investment Board) through Wilton Re. They were originally known as Transamerica Life Canada, until 2015 when they were acquired by Wilton Re and renamed to ivari. As of August 15, 2022, ivari was acquired by Sagicor Financial Company. With headquarters in Toronto, ivari has offices in Vancouver, Calgary, London and Montreal to serve Canadians across Canada.

If you’re interested in a company that gives back to your community, ivari focuses on funding charities that are dedicated to the prevention and elimination of heart disease, stroke, cancer and diabetes. They’re also partnered with United Way Centraide Canada, where during their annual fundraising campaign, they match dollar-for-dollar funds raised by their employees. They also hold events throughout the year to raise additional funds for local United Way chapters.

ivari Life Insurance Pros

- Financially strong

- Joint insurance option for up to five insured lives

- Multiple term options

Single and joint life coverage can be mixed and placed on the same term policy

Great for layering policies

Competitive pricing in universal life insurance

Licensed nationwide, and available in all provinces and territories in Canada

ivari Life Insurance Cons

Limited online presence and no digital access to policy

- No whole life insurance policy

- Term life policies can be pricey compared to other competitors

Stricter underwriting process, potentially leading to higher premiums or eligibility issues

Limited investment features in life insurance products

Absence of specialized products tailored to specific demographics and professions

ivari Life Insurance Products

ivari Life Insurance Riders

Riders are add-ons that allow you to tweak your insurance coverage to suit your needs, usually for a small additional fee. ivari offers the following riders on their products:

- Critical Illness Protection – You receive a lump-sum benefit if you are diagnosed with a covered critical illness (e.g. a heart attack)

- Child Insurance Rider – Offers affordable coverage for the insured’s children. Once the child turns 18, they have the option to convert to whole life without a medical exam

- Accidental Death and Dismemberment – Pays an additional death benefit to your beneficiary in the event of death or dismemberment due to an accident

- Waiver of Premium – Waives off future premium payments if the insured becomes disabled

- Payor Waiver of Premium – If the insured is a minor and the payor stated in the policy becomes disabled, this rider waives any future premiums

- Term riders – You can buy additional term life insurance over and above your basic coverage, making layering policies easy. You can add a 10, 20, or 30 term, although the 30 year add-on does not include the SelectOptions.

ivari Insurance Term Life Insurance

ivari’s term life insurance is not competitively priced, with companies like RBC, Desjardins, Empire Life, and PolicyMe offering lower monthly premiums. iIvari’s Term 10 or 20 and Term 30 with SelectOptions are designed to offer flexibility and customization, with multiple rider options available for additional fees.

This product is a 10-year term product that is ideal for layering with other ivari life insurance products. Their Term 10 product is a good fit if you need insurance protection for a short amount of time to cover specific debt, such as the last few years of your mortgage, start-up and overhead costs for a business, or just a for a cost-effective insurance option.

Key Highlights:

- Coverage up from $50,000 to $50,000,000 for single life policies

- Renewable every 10 years until age 80

- Convertible into permanent life insurance until age 71

Optional add-ons:

- Children’s insurance rider

- Accidental death and dismemberment

- Waiver of Premium (Single Life policies only)

This product is a 20-year term product that is ideal for those looking to cover income replacement and debts like loans or mortgages. It may be a good option for individuals looking for affordable insurance coverage with future flexibility, or business owners who want to cover start-up and overhead costs.

Key Highlights:

- Coverage up from $50,000 to $10,000,000 for single life policies

- Renewable every 20 years to age 80

- Convertible into permanent life insurance until age 71

Optional add-ons:

- Critical illness rider

- Children’s insurance rider

- Accidental death and dismemberment

- Waiver of Premium (Single Life policies only)

TERMSelect 30 is ivari’s innovative term offering that has 3 different options to choose from, which are available from the 15th coverage anniversary until the 20th coverage anniversary.

Key Highlights:

- Coverage up from $50,000 to $10,000,000 for single life policies

- Renewable every 30 years at level premiums to age 100

- Convertible into permanent life insurance until age 90

Optional add-ons

- Critical illness rider

- Children’s insurance rider

- Accidentl death and dismemberment

- Waiver of Premium (Single Life policies only)

SelectOPTIONS include:

- Select30: Allows clients to stop paying premiums and reduce the amount of insurance coverage for the remainder of their 30-year term

- SelectLIFE: offers a paid-up lifetime final expense coverage with the ability to stop paying premiums, reduce the amount of your insurance coverage and extend it for life

- SelectVALUE: allows you to access the policy cash value by decreasing the coverage or converting to a universal life policy

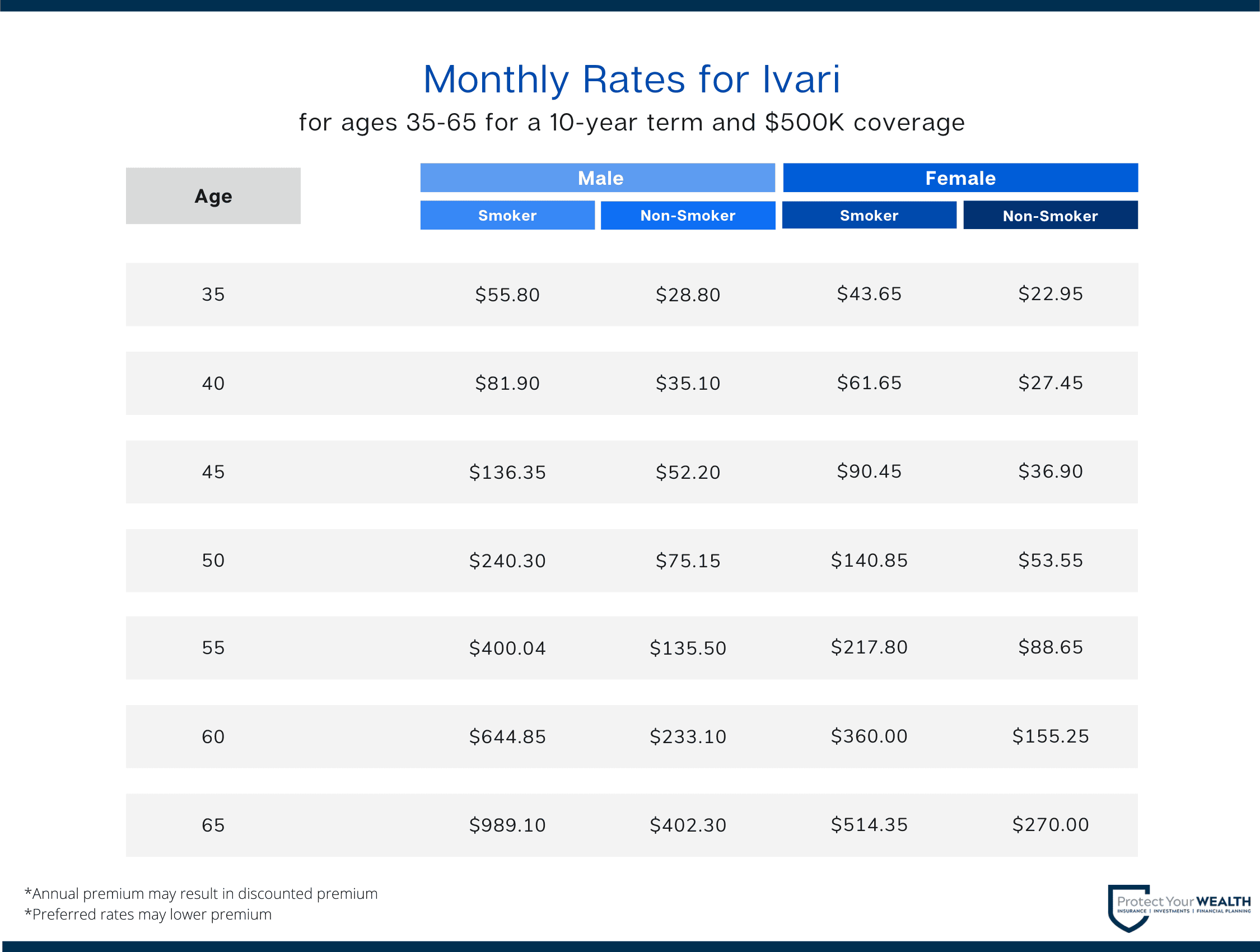

ivari Term Life Insurance Rates

Term life is a good option for most people, because of its flexibility and affordability compared to other life insurance products, and provides coverage for only those years when you need it most. Below is a chart of ivari’s term life insurance rates for ages 35-60 years for a 10 year term policy with coverage of $500,000.

ivari Permanent Life Insurance

Permanent life insurance provides coverage for life and builds cash value. Ivari only offers universal life insurance, but their universal life insurance comes with two options: with bonus and no bonus. Both of these options allow policyholders to change their premiums, death benefit and investment options as their needs change, and add additional riders and benefits that suit their protection needs and budget.

ivari Universal Life Insurance

ivari is competitively priced in the Universal Life category, consistently ranking as one of the three cheapest insurers for Universal Life in Canada. This product offers tax-deferred investment growth, flexibility in premium and death benefit adjustments, and has options for guaranteed bonuses.

ivari Universal with bonus is ideal for clients that are younger and have a long-term investment outlook.

Key Highlights:

- It provides an “accumulation bonus” which is credited to the investment account every year starting in the second year of the policy at a fixed rate of 0.75%. There’s also a Performance bonus, which is based on the performance of the funds chosen

- Available as a single or joint policy

- Coverage available from $25,000 to $20,000,000

- Includes Living Benefits and Compassionate Assistance Program (CAP) benefits at no extra cost

Optional additional benefits:

- TERMSelect Riders (10 year, 20 year, or 30 year)

- Critical Illness Protection Rider (not available on Joint Life plans)

- Accidental Death and Dismemberment rider

- Children’s Insurance Rider

- Waiver of Premium rider

ivari Universal no bonus is ideal for clients who prefer to have control over their investment choices over the short and/or long term. Since there are no bonuses, there are discounts in fees in exchange for not having any bonuses.

Key Highlights:

- Available as a single or joint policy

- Coverage available from $25,000 to $20,000,000

- Includes Living Benefits and Compassionate Assistance Program (CAP) benefits at no extra cost

Optional additional benefits

- TERMSelect Riders (10 year, 20 year, or 30 year)

- Critical Illness Protection Rider (not available on Joint Life plans)

- Accidental Death and Dismemberment rider

- Children’s Insurance Rider

- Waiver of Premium rider

Other Life Insurance Products

ivari offers Critical Illness Insurance Protection as a rider to term or permanent life insurance plans, but also as its own standalone product. Critical illness protection helps you pay medical bills so that you do not drain your retirement savings if you develop a serious illness.

ivari offers either a 4-condition coverage or 25-condition coverage for their Critical Illness Protection product. The 4-condition coverage option covers the following conditions:

- Heart attack

- Cancer

- Stroke

- Coronary artery bypass surgery

The 25-condition coverage covers all these conditions and 21 others, including blindness, severe burns, and loss of speech. If you’re not sure if critical illness is right for you, check out our guide on critical illness or talk to an advisor.

Critical Illness Protection from ivari provides a lump-sum Critical Illness Benefit when you are diagnosed with a covered condition (either of the 4 or 25 conditions, depending on which plan you choose) and you survive the 30-day survival period. The money you receive can be used however you choose, without restrictions.

Key Highlights:

- Offered in term 10, term 20, and term to age 65 with level premiums

- Term 10 and term 20 Critical illness coverage are renewable and expire at age 75

- Available as single life and multiple life plans

- Coverage amount available from $25,000 to $2,000,000

- Critical Illness Protection Benefit: a one time lump sum payment upon diagnosis of a covered condition and survives the 30-day survival period

- Early detection benefit: a one time lump sum per policy upon diagnosis of one the Early Detection covered conditions and survives the 30-day survival period

- Return of Premium on Death benefit: a one time lump sum payment upon the death of the insured (not payable if the Critical Illness Protection Benefit has been paid)

- Virtual Healthcare by Maple – Access some of the Canada’s top doctors who will review your case and advise your physician

Additional riders:

- Waiver of Premium

- Payor waiver of premium

ivari Insurance Customer Reviews

Finding reviews for insurance companies can be tricky, as taking online life insurance reviews at face value will not always be a good representation of an insurance company as a whole. Statistically speaking, people share their bad experiences more often than their good ones, which means, in a review section, you are likely to come across many customers who were not fully satisfied with something or encountered a bad experience. Despite this, Ivari has an average Google star rating of 2.5 out of 5 stars, based on 116 reviews. Customer experiences vary, with some praising the smooth claim experience and customer support, while others have reported issues with policy cancellation and premium charges.

From these reviews, many ivari clients are satisfied with their experience with the company:

- Enjoy the security of working with an established and financially stable firm

- Enjoy the flexible and customizable 30 year term insurance options

However, some customers have been found that:

- The customer service can be lacking with miscommunication errors

- Unable to reach the company with concerns about their payments and policies

- There is no digital access to policies

Bottom Line

While Ivari is a reliable and well-established insurer with extensive customization options, it falls short in pricing competitiveness for term life insurance, online presence, and specialized product offerings. It is suitable for those valuing product customization and those seeking competitive universal life insurance but may not be the optimal choice for price-sensitive consumers or those looking for a seamless online experience.

Frequently Asked Questions (FAQs) about ivari Life Insurance

Since it has been in business for 80 years, ivari has had a strong financial foundation thanks to its parent company, the Canadian Pension Plan Investment Board. This has earned it an A+ grade from AM Best Company for financial strength. Moreover, they’re one of the best insurance companies in Canada, offering 10 year, 20 year, and a 30 year term life insurance with unique features. Some of the many great features of ivari are: providing joint insurance option for up to five insured lives, having multiple term options, being financially strong, they’re great for layering policies, and they provide single and joint life coverage which can be mixed and placed on the same term policy

With this in mind, it is worthy to mention that they do not provide whole life insurance products, and have no digital access to their policy. Also, their term life policies can be pricey compared to other competitors. This is why at Protect Your Wealth, we rate them a 3.5/5 stars.

ivari is best suited for individuals seeking diverse coverage options, flexible payment plans, and competitive pricing in universal life insurance. It’s particularly fitting for those who prefer customization and are not primarily driven by price in term life insurance

If your insurance policy with ivari has no cash value and you would like to cancel it, send a letter of direction containing the names of the policy owner(s), insured(s), and policy number. There must be signatures from all policyholders and, if relevant, irrevocable beneficiaries. ivari’s online tool is the quickest and most convenient way to email your fully completed and signed forms. These tools rapidly send forms out! Alternately, you can submit your completed forms to:

ivari

500-5000 Yonge Street

Toronto, Ontario M2N 7J8

If your insurance policy with ivari has cash value and you would like to cancel it, you may cancel by completing sections 1, 5(b) & 7 of the policy service form and signing it on page 4. Please keep in mind that there may be a taxable consequence. You can also use the online tool or speak to our advisor to assist you with any concerns.

ivari offers term life insurance in 10 year, 20 year, and 30 year terms. Their 30 year terms have a few options to pick from:

ivari TERMSelect 10 is a 10-year term product that layers well with other ivari policies. Their Term 10 product is ideal if you need insurance for a short time to cover specific debt, such as the last few years of your mortgage or business start-up and overhead fees.

ivari TERMSelect 20 is a 20-year term package that covers income replacement and loans or mortgages. It may be an excellent alternative for people looking for affordable insurance with future flexibility or business owners covering start-up and overhead costs.

ivari TERMSelect 30 with SelectOPTIONS is ivari’s innovative term offering provides 3 options from the 15th to 20th coverage anniversary.

For permanent insurance, ivari only offers universal life insurance, but their universal life insurance comes with two options: with bonus and no bonus.

- ivari Universal with bonus is ideal for clients that are younger and have a long-term investment outlook.

- ivari Universal no bonus is ideal for investors who want short- and long-term control. Without bonuses, fees are discounted.

ivari also offers other life insurance products such as Critical Illness Protection.

Your life insurance coverage cannot be transferred from one provider to another. A life insurance policy might be difficult to transfer ownership of and may have tax repercussions. In the majority of Canadian provinces, it is illegal to sell or transfer a life insurance policy to a third party. Additionally, it is feasible to change the beneficiary of your life insurance policy, but if the original beneficiary was irreversible, you will need their consent.

The duration of a term life insurance policy is limited. Typically, a policy lasts between 5 and 30 years and is renewed at a higher cost. Policyholders who outlive their coverage have the choice of renewing their policy, forgoing life insurance and cancelling their policy, acquiring new coverage at a lesser rate, or converting their coverage to a whole life insurance policy.

Customer service at ivari is known for its supportive and guiding approach, but user experience may be hampered by a limited online presence and self-service options.

Get In Touch With Us Today

If you’re not sure of what’s the best insurance plan for you, working with a life insurance specialist can help you find the best solution to fit your particular situation. At Protect Your Wealth, we’ve been providing expert advice for all types of life insurance, including for no medical life insurance, term life, critical illness insurance, or permanent life insurance, since 2007. As your Life Insurance broker and financial planner, we work with you to create a personalized plan for you and your family, or business that covers and meets your needs.

Contact Protect Your Wealth or call us at 1-877-654-6119 to talk to an advisor today. We’re proudly based in Dundas, and service clients anywhere in Ontario, British Columbia, and Alberta, including areas such as Cambridge, Mississauga, Burnaby, Maple Ridge, and St. Albert.

![How Life Insurance Riders Work In Canada [2025]](https://protectyourwealth.ca/wp-content/uploads/2022/06/life-insurance-rider-header-500x383.png)

Leave A Comment